The Great Smoky Mountain Journal

Staff, Wire Reports

Posted: Sunday, January 21, 2018 07:20 PM

House Republicans Unveil Tax Reform Bill Thursday Lowering Taxes For "All" And Increasin Take Home Pay For Millions

House Republicans unveiled their tax reform bill Thursday – leaving in place current 401(k) retirement plans and eliminating some state deductions.

President Trump praised the plan but said “there is much work left to

do.”

Here’s a look at what the legislation tackles.

401(k) plans

Despite weeks of arguing among lawmakers, the bill didn’t change the

401(k) retirement plans. Republicans had considered slashing pretax

donation limits from $18,000 to as low as $2,400 for some Americans.

After the tax reform framework was revealed last month, some lawmakers

grumbled about a provision that would eliminate state and local tax

deductions – meaning taxpayers in high-taxed states would lose a

write-off. This impacted mostly blue states, such as California and New

York.

The latest bill ditches a full repeal of the deductions, called SALT,

and instead leaves in place state and local property tax deductions up

to $10,000. However, other deductions – such as income and sales tax –

would be eliminated.

With tax reform front and center, President Trump and the GOP aim to get

rid of state and local tax deductions, or SALT, when filing federal

returns.

While some advocates say eliminating

SALT could generate at least $1.3 trillion in revenue over a decade for

the federal government, could this create a red-blue state divide and a

sticking point to passing tax reform?

“I view the elimination of the deduction as a geographic redistribution

of wealth, picking winners and losers,” said Rep. Lee Zeldin, R-N.Y.,

who also said he doesn’t support the current bill.

Corporate taxes

The corporate tax rate would be lowered to 20 percent from 35 percent.

It’s unclear if this reduction would be immediate or gradually

implemented.

Mortgage deduction

The plan would drastically reduce the cap on the popular deduction to

interest on mortgages to $500,000 for newly purchased homes from the

current cap at $1 million.

Child tax credit

The child tax credit is raised to $1,600 from $1,000. The $4,050 per

child exemption is also eliminated.

Sen. Marco Rubio, R-Fla., said in a tweet that the House tax plan was

“only [the] starting point.” He said the $600 child tax credit was not

enough to help working families.

Marco Rubio ✔@marcorubio

House #TaxReform plan is only starting point.But $600 #ChildTaxCredit

increase doesn’t achieve our & @potus goal of helping working families

High-income households

The legislation eliminates the Alternative Minimum Tax, a supplemental

tax meant to offset benefits a person with a high income could receive.

The bill also phases out the so-called estate tax – sometimes referred

to as a “death tax” by opponents.

The federal estate tax generally

affects wealthier Americans because it is only levied on a portion of an

estate value transferred after death that exceeds a certain exemption

level, according to the Center on Budget and Policy Priorities.

Tax filing

The legislation aims to simplify how Americans file their taxes. The

filing system would be able to be completed on a postcard with just 15

lines for most Americans.

The plan also shrinks the number of tax brackets from seven to three or

four, with respective tax rates of 12 percent, 25 percent, 35 percent

and a category still to be determined.

“This is the beginning of the end of this horrible tax code in America,”

Rep. Kevin Brady, R-Texas, told Fox News.

The plan sets a 25 percent tax rate starting at $90,000 for married

couples, with a 35 percent rate beginning to bite at $260,000 — which

means many upper-income families whose top rate is 33 percent would face

higher taxes. Individuals making $500,000 and couples earning $1 million

would face the current Clinton-era top rate of 39.6 percent.

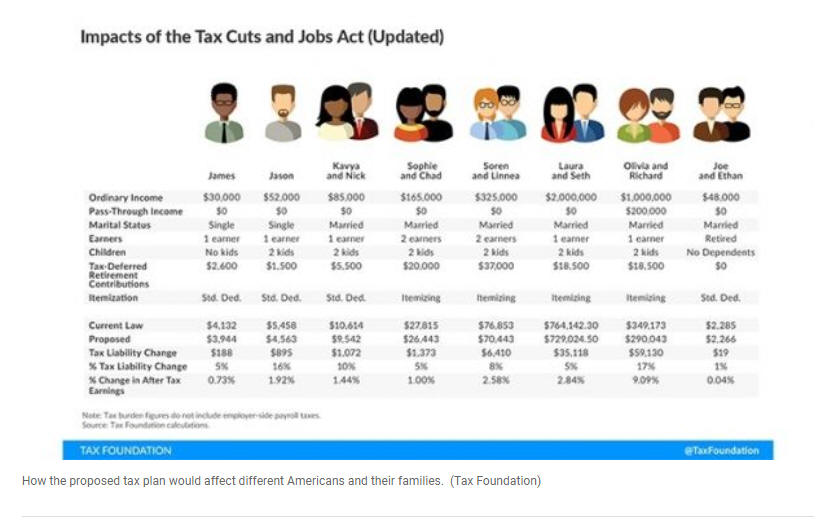

The non-partisan Tax Foundation has reviewed the proposal to determine

how the new rates and deductions could affect single and multiple-income

earning households. “Our results indicate a reduction in tax liability

for every scenario we modeled, with some of the largest cuts accruing to

moderate-income families with children and fixed-income retirees,” the

group said in its review.

MORE:

House Republicans on Thursday unveiled

their long-awaited tax bill which preserves the popular 401K retirement

account, lowers rates for many individual households but trims

deductions for state and local taxes.

The proposal, which was touted as a "game changer," would add $1.5

trillion to the nation's debt over the next decade as Republicans

largely abandoned fiscal discipline in a plan that could secure a

legislative achievement for President Trump and score a political win

ahead of next year's midterm elections.

Trump promised in a statement that his administration "will work

tirelessly to make good on our promise to the working people who built

our nation and deliver historic tax cuts and reforms -- the rocket fuel

our economy needs to soar higher than ever before."

A summary of the plan, which was made available to reporters ahead of

its public release, would also reduce the cap on the popular deduction

to interest on mortgages to $500,000 for newly purchased homes. The

current cap is $1 million.

The plan also limits the deductibility of local property taxes to

$10,000 while eliminating the deduction for state income taxes.

Republicans in high-tax states such as New York and New Jersey had come

out strongly against it.

“I view the elimination of the deduction as a geographic redistribution

of wealth, picking winners and losers,” New York Republican Rep. Lee

Zeldin said. “I don’t want my home state to be a loser, and that really

shouldn’t come as any surprise.”

Called the Tax Cuts and Jobs Act, the GOP plan would also leave the top

individual tax rate at 39.6 percent.

The child tax credit will rise to $1,600 from $1,000, though the $4,050

per child exemption would be repealed.

The legislation is the first major revamp of the U.S. tax code in three

decades and has been a top legislative and political priority of

Republicans.

“This is the beginning of the end of this horrible tax code in America,”

Rep. Kevin Brady told Fox News.

House Speaker Paul Ryan touted the plan as a break for the middle class.

“It is for the families who are out there living paycheck to paycheck

who just keep getting squeezed," he said.

President Trump called the legislation "another important step toward

providing massive tax relief for the American people" and added, "We are

just getting started, and there is much work left to do."

The rollout was delayed a day as Republicans were still hammering out

specifics.

Lawmakers had been at odds and scrambling to bridge deep divides over

contribution limits to 401(k) retirement accounts and the possible

elimination of a tax break for state and local taxes.

Potential changes to the plans created an uproar after rumors surfaced

that Republicans were considering a plan to slash pretax donation limits

from $18,000 for most people to as low as $2,400.

Trump is expected to meet with House Republicans at the White House

Thursday afternoon. Markups to the bill could come as early as Monday.

The House Ways and Means Committee plans to consider the bill next week.

"This is our opportunity to make tax reform a reality and deliver the

most transformational tax cuts in a generation," Brady said on Thursday.

House Majority Leader Rep. Kevin McCarthy, R-Calif., said Thursday that

this bill "for every member, this could be the most significant bill

they make a decision on in congress."

Trump has recently said he’d like to see the bill become law by

Christmas

Fox News’ Chad Pergram and Barnini Chakraborty contributed to this

report. The Associated Press also contributed to this report.